BTC Price Prediction: Why Bitcoin Could Reach New All-Time Highs Soon

#BTC

- BTC trading above key moving averages with bullish MACD crossover

- Institutional accumulation continues with MicroStrategy's latest purchase

- Market structure suggests potential breakout above $121K resistance

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Point to Continued Upside

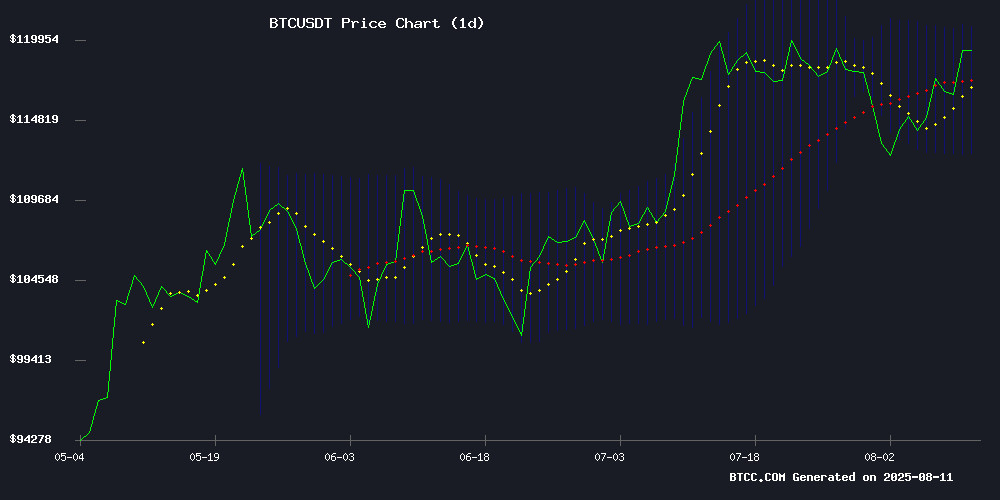

According to BTCC financial analyst John, BTC is currently trading at $118,826.78, comfortably above its 20-day moving average of $116,731.21. The MACD indicator shows bullish momentum with a positive histogram value of 342.35. The price is hovering NEAR the upper Bollinger Band at $120,765.12, suggesting strong upward pressure. 'These technical indicators collectively paint a bullish picture,' John notes. 'The fact that we're trading above all key moving averages with expanding Bollinger Bands indicates room for further upside.'

Market Sentiment Turns Extremely Bullish as Institutional Demand Grows

BTCC's John points to multiple bullish catalysts in today's news flow. 'MicroStrategy's latest $18 million Bitcoin purchase brings their total holdings to 628,946 BTC - over 3% of circulating supply. This institutional demand, combined with retail FOMO as we approach the $121K level, creates powerful upward momentum.' John highlights growing institutional adoption and innovative mining solutions as key drivers. 'When you see Swiss-regulated mining platforms and AI-powered sustainable solutions entering the space, it signals maturing infrastructure that supports higher valuations.'

Factors Influencing BTC's Price

CryptoAppsy Enhances Real-Time Market Tracking for Cryptocurrency Investors

CryptoAppsy emerges as a pivotal tool for cryptocurrency investors, offering real-time price streaming and historical data across thousands of assets, including Bitcoin and altcoins. The app's lightweight design and absence of mandatory account creation streamline access to instantaneous market updates, crucial for capitalizing on arbitrage opportunities and sudden price movements.

Portfolio management is simplified with manual input features that automatically update asset valuations. The app aggregates preferred cryptocurrencies into a single watchlist, eliminating the need to navigate multiple exchange platforms. Expert-curated news further ensures users stay informed on market trends without sifting through irrelevant information.

MicroStrategy Expands Bitcoin Holdings to 628,946 BTC with Latest $18 Million Purchase

MicroStrategy has reinforced its position as the largest institutional Bitcoin holder, acquiring an additional 155 BTC for $18 million at $116,401 per coin. CEO Michael Saylor announced the purchase on X, highlighting a 25% year-to-date Bitcoin yield for 2025. The company's total holdings now stand at 628,946 BTC, acquired at an average price of $73,288 per coin.

The move follows a series of strategic accumulations, including 821 BTC bought on July 29 at $117,256 each—now showing $64.9 million in unrealized gains—and 862 BTC purchased earlier in July at $118,940, yielding $7.3 million in profits. Market response was immediate, with MicroStrategy's stock surging 9% to $404.90, while Bitcoin traded at $119,665, up 0.95% over 24 hours.

Bitcoin Nears $121K as Institutional and Retail Forces Shift

Bitcoin surged past $120,480, marking a 1.48% gain in 24 hours as trading volume hit $87.95 billion. The rally follows Trump Media’s updated S-1 filing for a Bitcoin ETF, with Crypto.com stepping in as custodian. BlackRock’s ETF milestone in July and fresh institutional buys from French-listed Capital B and MicroStrategy added fuel to the uptrend.

Glassnode data reveals a volatility spread of 10.45, signaling moderate price fluctuations, while spot volume dipped to $5.71 billion—a potential consolidation signal. ETF trade volume remains robust at $13.73 billion weekly, with a realized profit-to-loss ratio of 1.92, underscoring investor profitability.

The rebound from last week’s sub-$114K dip now faces a critical test: whether the recovery sustains or profit-taking dominates. Market signals oscillate between strength and caution as Bitcoin eyes $121K.

Bitcoin Nears All-Time High as Institutional Demand Grows

Bitcoin's rally accelerates as price breaches $122,000, marking a 9% weekly gain. The move reflects growing institutional participation, with corporate treasuries increasing allocations following regulatory clarity.

Technical indicators suggest bullish momentum, with the cryptocurrency testing the 1.618 Fibonacci extension level. Market depth has improved substantially, evidenced by rising volumes across both retail and institutional platforms.

Macroeconomic tailwinds emerge as expectations build for a September Fed rate cut. The shift in monetary policy outlook is driving capital into risk assets, with Bitcoin capturing significant flows alongside traditional markets.

MicroStrategy Boosts Bitcoin Holdings with $18M Purchase, Now Controls Over 3% of Circulating Supply

MicroStrategy Incorporated (MSTR) shares climbed 2.84% to $406.37 following its latest Bitcoin acquisition. The enterprise software firm purchased 155 BTC for approximately $18 million, paying an average of $116,401 per coin. This brings its total holdings to 628,946 BTC—worth over $75 billion at current prices—representing roughly 3.16% of Bitcoin's circulating supply.

The August 11 transaction continues MicroStrategy's aggressive accumulation strategy under executive chairman Michael Saylor. Year-to-date, the company has achieved a 25% yield on its Bitcoin position. MicroStrategy remains the dominant corporate holder of BTC, with its $46.09 billion total investment averaging $73,288 per coin.

Top Swiss-Regulated Bitcoin Cloud Mining Sites to Safeguard Your Crypto Investments

Switzerland has long been synonymous with financial security and innovation, now emerging as a haven for Bitcoin cloud mining. The country's stringent regulations and stable economy provide a secure environment for both novice and seasoned investors. Hydro-powered MiningToken, a Swiss-regulated platform, offers a free $100 AI mining contract upon sign-up, eliminating the need for hardware mining.

The Swiss blockchain sector thrives under clear regulatory frameworks, ensuring investor protection. Renewable energy sources like hydro, solar, and wind power dominate the cloud mining infrastructure, aligning with global sustainability goals. This combination of regulatory rigor and environmental consciousness positions Switzerland as the premier destination for cloud mining.

AI-Powered Cloud Mining Meets Sustainability: How AIXA Miner is Redefining Crypto Profits in 2025

In 2025, the convergence of artificial intelligence and ecological sustainability has reshaped the cryptocurrency mining landscape. AIXA Miner emerges as a pioneering force, leveraging AI-driven cloud mining to democratize access to Bitcoin (BTC) profits while championing clean energy initiatives.

Gone are the days when mining required specialized ASIC hardware and cheap electricity. AIXA Miner's platform eliminates these barriers, offering a seamless entry point for retail investors. The real innovation lies in its environmental commitment: operations run entirely on renewable energy, with a roadmap to carbon neutrality by 2025.

The platform represents a paradigm shift in digital asset infrastructure. By combining algorithmic efficiency with sustainable power sources, AIXA Miner addresses crypto mining's historic energy dilemma. This dual focus on profitability and planetary impact positions the company at the forefront of Web3's green revolution.

Is BTC a good investment?

Based on current technicals and market sentiment, BTC appears to be a strong investment candidate. Consider these key factors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $118,826.78 | Testing resistance near $121K |

| 20-day MA | $116,731.21 | Healthy support level |

| MACD | 342.35 (bullish) | Positive momentum |

| Institutional Holdings | MicroStrategy: 628,946 BTC | Strong institutional vote of confidence |

John from BTCC summarizes: 'The combination of technical strength, growing institutional adoption, and positive market structure suggests BTC could be positioned for further gains. However, investors should always consider their risk tolerance.'